Enhance your financial flexibility

Would you like to enhance your financial independence in order to be able to respond to your needs in a more flexible manner?

The innovative Cash Loan Plus offers you maximum financial freedom:

-

A plus with regard to flexibility:

Withdraw money as needed for 24 months within the framework of the agreed credit limit*. You can obtain money exactly when you need it.

-

A plus with regard to security:

Financial independence owing to a money reserve tailored to your needs.

-

A plus with regard to predictability:

The repayments, tailored to your monthly budget, remain unchanged during the entire credit period.

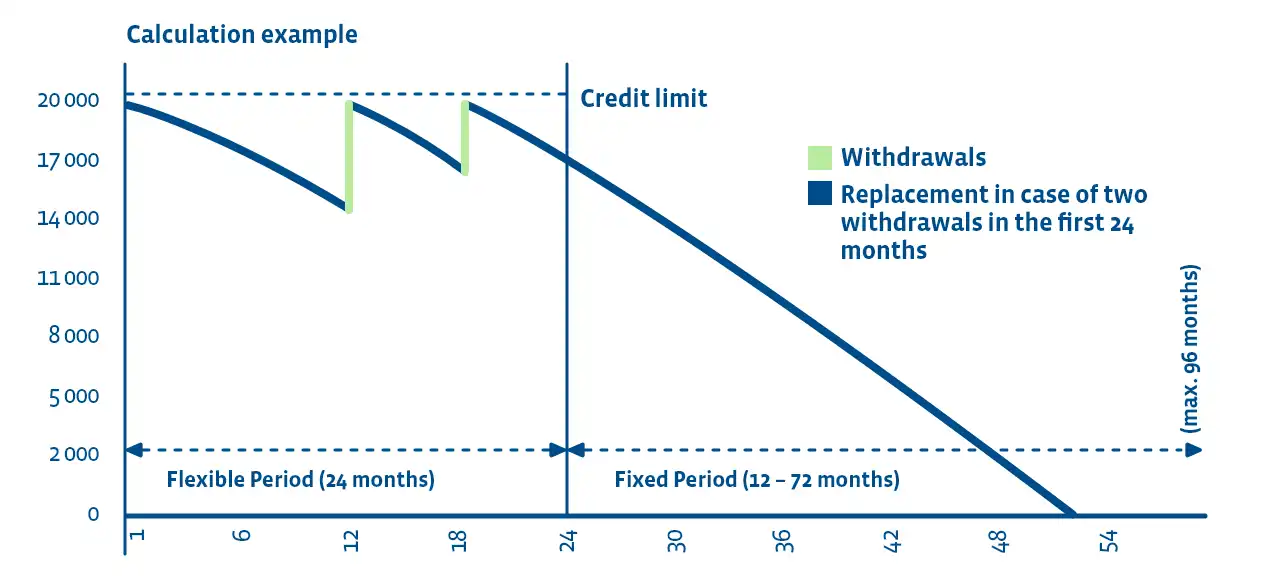

During the flexible period you can withdraw money as needed* for 24 months within the agreed credit limit. Thus you have maximum financial freedom.

The fixed period begins after these 24 months. From this point in time no further withdrawals can be made from this account. The term of this period varies between 12 and 72 months.

The repayments, which are set in line with your monthly budget, remain the same for the entire credit period for Cash Loan Plus. This makes it easier to plan and provides more security. Only the term can change, depending on the withdrawals you made during the flexible period.

Calculation example

Credit limit: CHF 20,000. If you claim the maximum amount of CHF 20,000 at the beginning of the flexible term, and, in addition, make withdrawals of amounts of up to the agreed credit limit after 12 and 18 months, the following costs arise (rounded to CHF 10):

| Interest rate | 9.95% |

| Initial payout (CHF) | 20'000.00 |

| Additional withdrawal after 12 months (CHF) | 5'000.00 |

| Additional withdrawal after 18 months (CHF) | 3'000.00 |

| Total amount paid out (CHF) | 28'000.00 |

| Total costs (CHF - interest and charges)** | 5'343.00 |

| Contractually agreed repayment (CHF - calculation base 36 months) | 642.40 |

| Total no. of repayments (actual term of the loan) | 53 |

Thinking ahead

We recommend you take out Payment Protection Insurance when signing your Cash Credit agreement. This ensures that you remain solvent if you are not able to work due to illness or accident or if you become undeservedly unemployed.

* Provided that there has been no negative change in your financial situation.

** The total costs and actual term are based on the sample calculation. These vary depending on the number and amount of withdrawals.