You would like to realize your plans

You have ideas and wishes which are important to you. With Cembra Money Bank Cash Loan you can realize your ideas and meet your needs.

The most important facts – point by point

The most important information concerning your Cembra Money Bank Cash Loan at a glance:

- Opt for a loan amount between CHF 1000 and CHF 250,000.

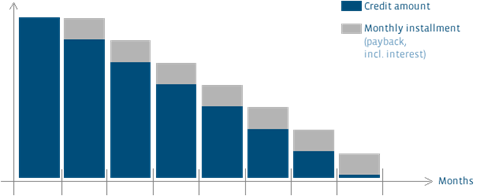

- Choose a term which suits your needs between 12 and 84 months.

- Your loan repayments fit comfortably into your monthly budget.

- We provide interest rates starting from 7.95% up to 11.95%.

- In many places, your interests are tax deductible (enquire at your local tax office).

- In the event of death, your remaining debt of up to CHF 60,000 is insured.

- We recommend you take out the optional Payment Protection Insurance.

How can you get Cash loan? You find all relevant information under Cash loan application process.

Apply for Cash Loan – in a fast and uncomplicated way

Are you interested in obtaining a Cembra Money Bank Cash Loan? Look at the fast and uncomplicated steps to take in order to get your Cash Loan:

-

Fill in the online application

-

We will carefully and discreetly check your application.

-

We will prepare an offer that is personalised for you and then send you the loan agreement documents for you to sign.

-

After a legally mandated cooling off period of 14 days has expired, you will receive the approved loan transferred to your bank account.

-

Every year we will send you a detailed interest and capital statement.

We offer financing solutions tailored to your needs

Cembra Money Bank provides you with competent and discreet support when you need a large amount of financial flexibility. You can select a loan amount that is tailored flexibly for you ranging from CHF 500 to CHF 250,000. The fixed repayments mean that you know exactly what your costs are every month.

If you have a loan with another financial company, you can even transfer your existing loan to us. Please contact a branch close to you.

Thinking ahead

Would you like to not have to worry about your financial obligations also in difficult times? We recommend you also take out Payment Protection Insurance* when concluding your Cash Loan agreement. This ensures that your monthly installments are financed if you are not able to work due to illness or accident or if you become undeservedly unemployed.